Lets talk about Derivatives!

What is Derivatives?

Derivatives is a financial contract or any product whose value is derived from its underlined asset. It means the value is depends on some else product price. Here, the underlined asset can be any:

Financial asset such as shares, bonds, debenture, etc.

Agri commodities such wheat, rice, bajra, etc.

Metal such as gold, silver, aluminum, etc.

Energy resources such as crude oil, electricity, coal natural gas, etc.

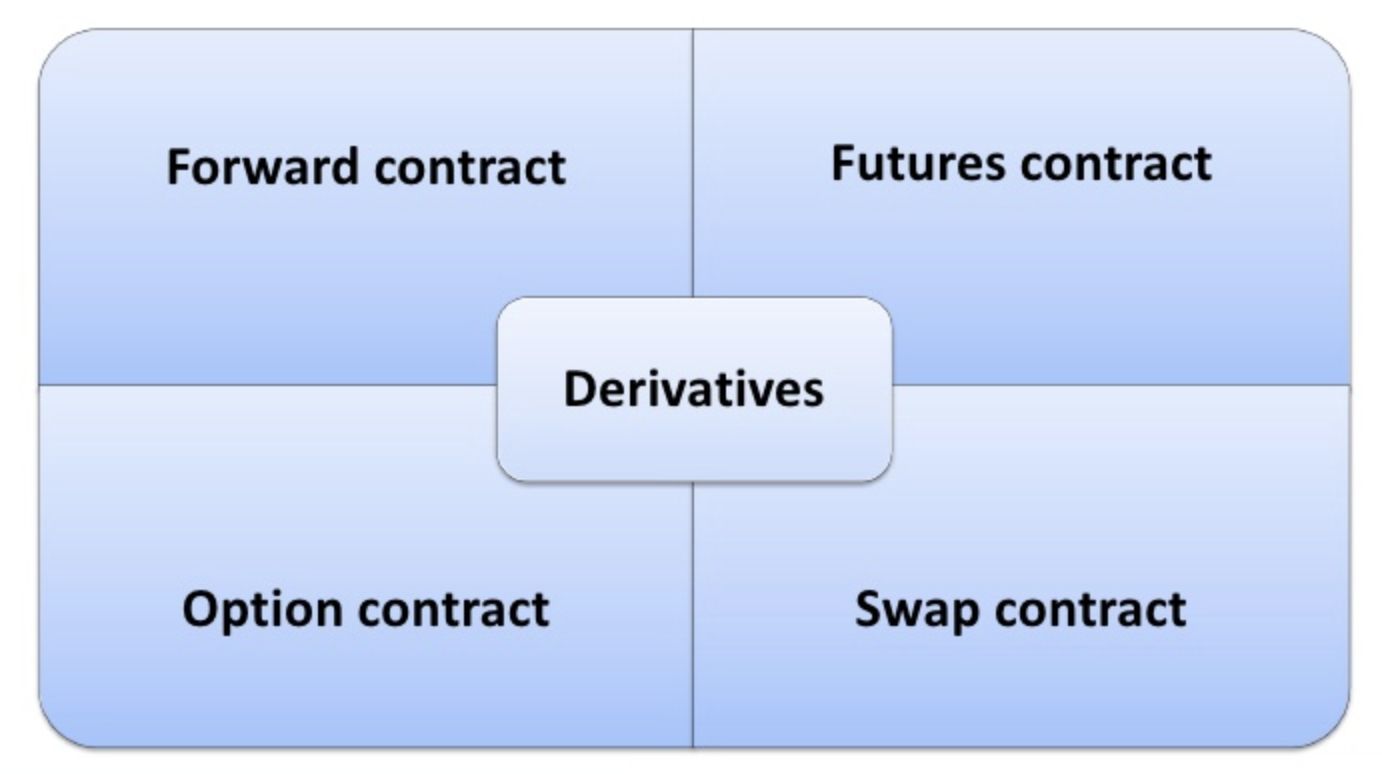

Products in Derivatives Market:

Futures:

A futures contract is similar to forward, except that the deal is made through an organized and regulated exchange rather than being negotiated directly between two parties.

Options:

An Options is contract that gives the right, but not an obligation to buy or sell the underlying on or before a stated date and stated price. While buyer(holder) of the contract will a premium to buy a right, whereas, seller(writer) of the contract will receive the premium.

Swaps:

A swap is a type of derivatives in which two counterparties exchange cash flows based on an underlier. Here the underlier could be equities, commodities, Interest rates or Currency.

Market Participants:

Comments

Post a Comment